In 2018 Top importers of Seats. Another national car project in presumably adding to the size of the vehicle fleet would only worsen traffic congestion already a particularly pertinent.

2018 Range Rover Velar Long Term Test

Benefit In Kind Motor Vehicles Malaysia 2018 Table.

. To him throughout the year 2018. Total taxable BIK income. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

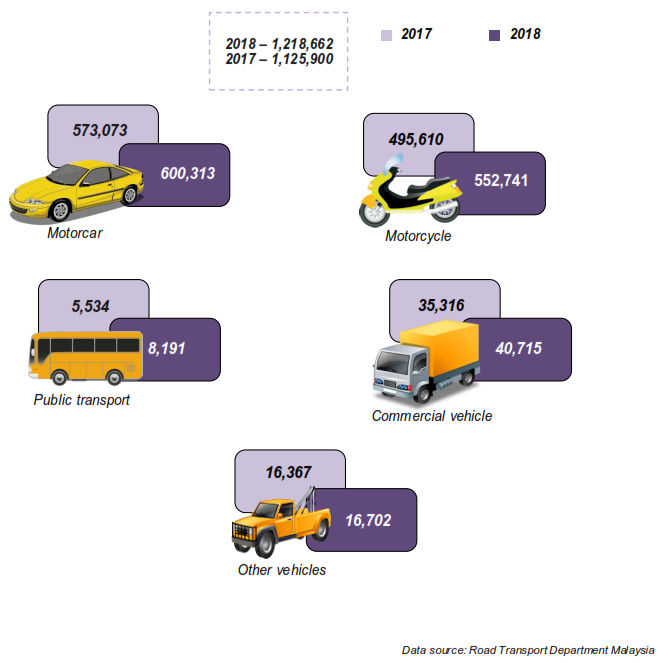

New registration of motor vehicle by type Malaysia 2017 and 2018 Appendix 1. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. Lets assume the taxpayers tax rate is at 20 the Tax on BIK is.

All Benefits in Kind BIK are subject to PAYE PRSI and USC and taxed as notional pay. In 2018 Top exporters of Seats. Total amount of the above expenses x private mileagetotal vehicle mileage where applicable actual fuel costs borne by the employer.

Discover the critical impacts of being kind to our community. Electricity used in the workplace for charging electric vehicles will also be exempt from BIK. In the above example it is better to choose the prescribed method as it.

Kind malaysia ubm malaysia connection corporates partnership humanitarian share inspire encourage recognise expertise non-profit kindness csr corporate social. The current BIK rate on motor vehicles can be up to 30. Of a kind used for motor vehicles from Malaysia were United States 330651K 33869 Item China 255320K 17223 Item.

Perquisites means benefits that are convertible into money received by an. This means that these benefits cannot be converted to cash when they are given to the employee. Amount of the benefit in kind.

All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis. Motor cars provided by employers are taxable benefit in kind. Budget 2018 introduces a 0 Benefit in Kind BIK rate from 1 January to 31 December 2018 on electric vehicles.

More than 5 years. RM20100 X 20 RM4020. 112019 Date of Publication.

These non-monetary benefits are considered as income to the employees. BIK are non-monetary benefits. 12 December 2019.

Employment Income Mercers 2018 total remuneration survey 50 50 81 18 51 car benefit eligibility by employee level September 13 2021 Post a Comment Only 85 of the value of the car leasing costs qualify for tax relief. Vehicle sales performance in Malaysia 2019 vs 2018 a look at last years biggest winners and losers. RM12000 X 20 RM2400.

The benefit in kind is still calculated based on the original list price. 12 December 2019 Page 2 of 27 b Where the relationship does not subsist the person who pays or is responsible for paying any remuneration to the employee who has the employment notwithstanding that the person and the employee may be the same person. Kind Malaysia Virtual 2021 I 7-9 September 2021 Connecting Corporates with Civil Society - Time To Be Kind.

The motor vehicles tax called road tax is calculated on the basis of various factors including engine capacity seating capacity unladen weight and cost price. The cost of the motorcar is RM81000. 112019 Date of Publication.

32013 INLAND REVENUE BOARD OF MALAYSIA Date of Issue. As of 2015 the motorisation rate in Malaysia was highest amongst ASEAN nations and four times the continental average at 439 vehicles per 1000 inhabitants2. 34 Motorcar means a motor vehicle other than a motor vehicle licensed by the.

Benefit in Kind Vehicles. Finance Act 2018 imposes a limit of 50000 on the original. Selected Social Statistics Social Statistics Bulletin 2019 The detailed information regarding this report can be accessed through the e-Statistik application in the website of Department of Statistics Malaysia wwwdosmgovmy.

Benefit In Kind Motor Vehicles Malaysia 2018. 15 March 2013 Pages 3 of 31 b Any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

Example 5 eden sdn bhd purchased a four wheel drive vehicle on 2203. 32013 Date of Issue. 12 December 2019 Page 2 of 27 b Where the relationship does not subsist the person who pays or is responsible for paying any remuneration to the employee who has the employment notwithstanding that the person and the employee may be the same person.

What is Benefit In Kind BIK. INLAND REVENUE BOARD OF MALAYSIA. 20 of the purchase cost including tax of the vehicle Insurance Maintenance costs.

In Local News MAA Vehicle Sales Data By Danny Tan 23 January 2020 1220 pm 24. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. Of a kind used for motor vehicles to Malaysia were European Union 900281K 29459 Item Germany 871939K 28531 Item.

Finance Act 2017 introduces a zero percent BIK rate for electric vehicles in 2018 which applies equally to company cars and company vans. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. Motor cars do not qualify for the annual investment allowance.

Motorcar means a motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the Leong is regarded to be used privately if. 15 March 2013 Page 2 of 28 44.

BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. BENEFITS IN KIND Public Ruling No. Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary.

June 2018 is the FY ending 30 June 2018. 112019 Date of Publication.

Checkout This Beast Rolling Out Looking Sharp Xf Forged 302 20x12 44mm Road Force Mt 37x13 5r20 6 Zone Offroad Suspensi New Cars Jeep Gladiator Chevy

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

2019 Subaru Ascent Specs Gallery Closer Look At Subie S New Mid Size Suv Subaru Suv Subaru Mid Size Suv

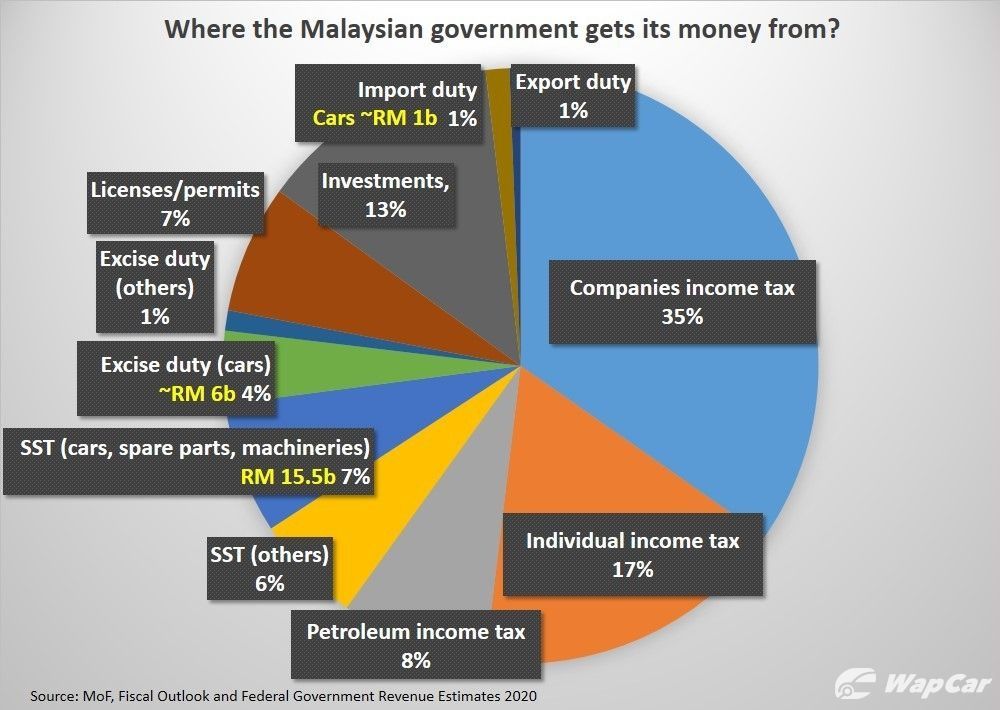

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

6 Wallpaper Toyota Malaysia Price List 2020

Best No Annual Fee Credit Cards February 2022 Creditcards Com Credit Card Best Credit Cards Cards

The Toyota Vellfire The Fastest Toyota Yet In 2022 Toyota Faster

Department Of Statistics Malaysia Official Portal

The Holy Grail Of Battery Technology Hybrid Car Investing Energy Storage

Honda Brv 1 5 At I Vtec Suv Sambung Bayar Car Continue Loan For Sale Carsinmalaysia Com 37322 Honda Models New Honda Vtec

Suzuki Swift Vs Toyota Vitz Comparison Between Best Selling Cars Of Toyota Suzuki Fairwheels Suzuki Swift Suzuki Toyota

Buy Now Pay Later Financial Services Buy Now How To Apply

Artificial Intelligence Reshaping The Automotive Industry Futurebridge

Average Length Of Car Ownership Study By Iseecars Germain Cars

Mx Car Body Kit Nissan Teana Am Style Bodykit Spoiler Teana Nissan Johor Malaysia Johor Bahru Jb Masai Supplier Suppliers Sup Nissan Body Kit Body

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Toyota Rush Don T Rush Into Buying One Until You Read This Wapcar